New Jersey Staple Jersey Mike’s Acquired for $8 Billion!

I’ve followed Jersey Mike’s extraordinary rise for years, and the announcement of its $8 billion acquisition by Blackstone feels like the start of a new chapter for the renowned sandwich brand. Jersey Mike’s, a brand profoundly ingrained in New Jersey culture, has gone a long way since its humble beginnings in 1956. With Blackstone’s financing, the company is now prepared to accelerate its local and international growth.

A Game-Changing Deal.

Blackstone, a worldwide investment management firm, has agreed to buy Jersey Mike’s Subs for approximately $8 billion, including debt. The partnership is intended to accelerate the chain’s growth and strengthen its technological capabilities. Insiders believe the deal will be completed in early 2025.

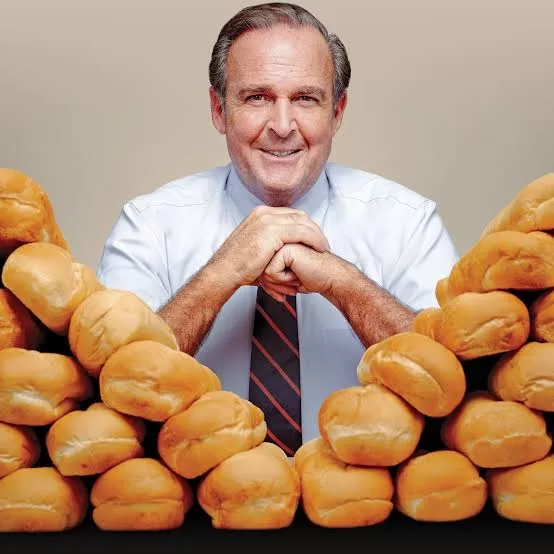

In an official statement, Jersey Mike’s CEO, Peter Cancro, expressed optimism: “We believe we are still in the early innings of Jersey Mike’s growth story, and that Blackstone is the right partner to help us reach even greater heights.” Cancro underscored Blackstone’s track record in developing global franchises, citing Hilton Hotels and Tropical Smoothie Cafe as prominent examples.

From Humble Beginnings to National Prominence.

Jersey Mike’s has an interesting founding story. The story began in Point Pleasant, New Jersey, at Mike’s Subs, a modest sandwich business. In 1975, a 17-year-old Peter Cancro, who had worked there since he was 14, took a chance and bought the shop with the assistance of his football coach. Today, that adolescent is the driving force behind a company with over 3,000 sites across the country.

It is important to note that the company’s success has not been only due to luck. The brand has been laser-focused on retaining high-quality ingredients and providing great customer service, a mix that has proven popular with sandwich aficionados across the country. Over the previous decade, the number of Jersey Mike’s locations has tripled, a remarkable increase that industry experts have praised.

Why Blackstone?

As I dug deeper into Blackstone’s investment history, the rationale for this acquisition became evident. Blackstone has a good track record of growing franchise operations. It just bought Tropical Smoothie Cafe in a high-profile deal aimed at driving expansion. With Jersey Mike’s, Blackstone sees an opportunity to enter the fast-casual dining segment, which is thriving despite problems in the overall restaurant industry.

Another major focus is on technological innovation. From internet ordering to delivery platforms, Jersey Mike’s has invested in technology to stay up with evolving consumer preferences. Blackstone’s skills and resources are likely to bolster these initiatives, allowing the company to remain competitive in an increasingly digital world.

The Road Ahead

As I listened to Peter Cancro’s statment, I couldn’t help but notice the enthusiasm he has for Jersey Mike’s. It is unusual to encounter a CEO who has been with a firm since its inception and continues to play an active part in its destiny. Cancro will keep a major equity position and continue to run the company, ensuring that the brand’s basic values are maintained during this next period of expansion.

Jersey Mike’s is more than simply a sandwich business to New Jerseyans like myself; it’s a cultural institution. As the company considers additional expansion, it will be intriguing to watch how it combines its heritage with its ambitions to become a global powerhouse.

It looks like this is more than just a financial transaction; it’s about a brand that has grown into a household name and the exciting path that lies ahead. As Jersey Mike’s begins its new era with Blackstone, one thing is certain: the customers and the media alike will keep an eye on this American success story.

Learn about Auto Draft.

Learn about Auto Draft.

Read more about Auto Draft.

Here’s an interesting read on Auto Draft.

Discover Auto Draft.

Learn more about Auto Draft.

Learn more about Auto Draft.